We continue to watch the news about the war in Ukraine and the dramatic human suffering. This war will have large direct and indirect impacts that will be felt globally, particularly in financial markets and international trade.

This is the second in a series on this war, and its short and longer term potential impacts on the financial markets and global trading products and partners.

Facts You May Not Know About Ukraine

The war in Ukraine will likely have significant impacts that will be felt globally, through destruction of agricultural, human, and other assets as well as important shifts in trading partners and allies. Here are some interesting statistics on key Ukrainian trading products and industries that have been dramatically changed by the current war.

- In the 1990s most natural gas Russia exported crossed Ukraine, but that role has diminished through use of new pipelines by about 2/3. Although Ukraine is still ranked 2nd in terms of known natural gas reserves in Europe, which remain largely untapped today, Ukraine’s need for energy fuels skyrocketed with Russia’s annexation of the Crimean peninsula, which held 80% of Ukraine’s oil and gas deposits in the Black Sea.

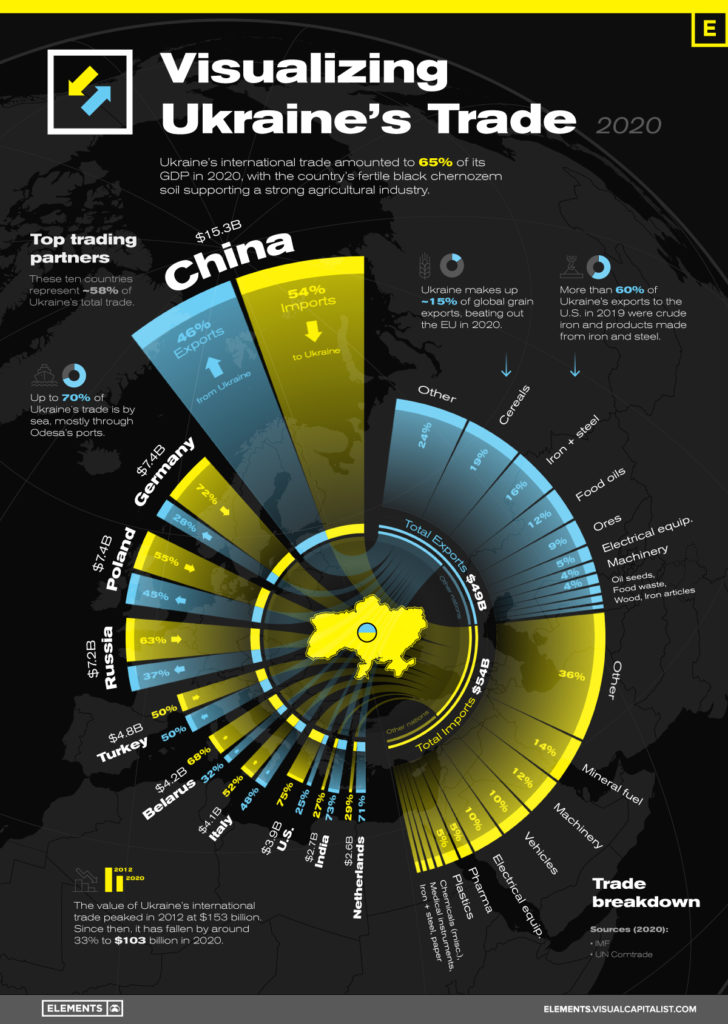

- Ukraine is the 5th largest exporter of wheat and makes up about 15% of the global grain exports (corn/wheat), exceeding that of EU. Russia is also the world’s largest exporter of wheat, accounting for 18% of international exports. Together, these areas account for over 1/4 of the world market, and 70% and 74% of Egypt and Turkey’s wheat imports respectively.

- Ukraine has about 1/5th of the global total and the world’s largest reserves of commercial grade iron ore.

- Ukraine is the 5th largest exporter of wheat and the world’s largest exporter of seed oils like sunflower and rapeseed oil.

- Coal mining, mechanical products (aircraft, turbines, locomotives, tractors) and shipbuilding are also of key importance to the Ukrainian economy.

- China and Poland have surpassed Russia as primary trading partners to Ukraine, as Ukraine continues to try to reduce Russian leverage over its economy. Trade between Russia and Ukraine peaked in 2011 at $49B and has fallen roughly 85% since then to $7.2B in 2020.

- Ukraine is still connected to the same power grid as Russia. The two countries still share economic links that continue to influence certain decision making.

- The port of Sevastopol, of the southwest edge of Crimea, is one of the few ice-free deep-water ports available to Russia in the region that provides access to the Mediterranean.

- Although not a NATO member, Ukraine is the 4th largest recipient of military funding from the US.

The Ukrainian War’s Most Significant Trading Products and Potential Partner Impacts

- Top exports for Ukraine in 2020:

- Corn/Wheat/Cereals 19.1%

- Iron and Steel 15.6%

- Animal or Veg. Oils 11.7%

- Ore, Slag, Ash 8.9%

- Electrical Equip. 5.2%

- Top imports for Ukraine in 2020:

- Mineral Pro. 13.8%

- Vehicles 11.7%

- Electrical Machinery 9.9%

- Pharmaceuticals 4.7%

- International trade amounted to 65% of its GDP in 2020, $103B, with a strong agricultural industry.

- China accounted for 54% of imports to and 46% of exports from Ukraine, $15.3B, more than double the value of any other trading partner.

- Germany and Poland together accounted for $14.8B ($7.4B each), with Russia the 4th largest contributor at $7.2B. Germany and Russia had significantly higher percentages of imports to Ukraine than exports.

- More than 60% of Ukraine exports to the US were iron ore and products made of iron and steel.

- The largest export partners were India (vegetable fats and oils, fertilizers, nuclear reactors, boilers and machinery, pharmaceuticals) and the Netherlands (grain, metals, seed oils).

- About 70% of Ukraine’s trade is by sea, mostly through Odessa’s ports on the Black Sea. At this writing Russia appears to be making a push to capture Odessa.

The Ukrainian War’s Impact on Future Trading Partners

- Four days into the war the Ukrainian President filed for special admission into the EU, which would strengthen their ever-increasing trade with EU members.

- Although China is Ukraine’s largest current trading partner the lack of condemnation of Russia’s actions could hasten the shift toward EU and Western allies, who are united in their support of Ukraine.

- The US and EU continue to commit significant financial support, certain military, and humanitarian aid to Ukraine.

It is too early to tell the ultimate result this conflict will have on international trade, but it seems likely that the countries supporting Ukraine today are likely to become top trading partners in the future.

Follow us on LinkedIn for timely and informative information that could/will impact our economy, the financial markets and alternative investments.