The US, and other countries around the world, are accelerating transitions to Electronic Vehicles (“EV”) to address oil dependence and climate change. This provides investors with multiple potential investment opportunities, as well as presents some challenges.

- Baseline current EV facts

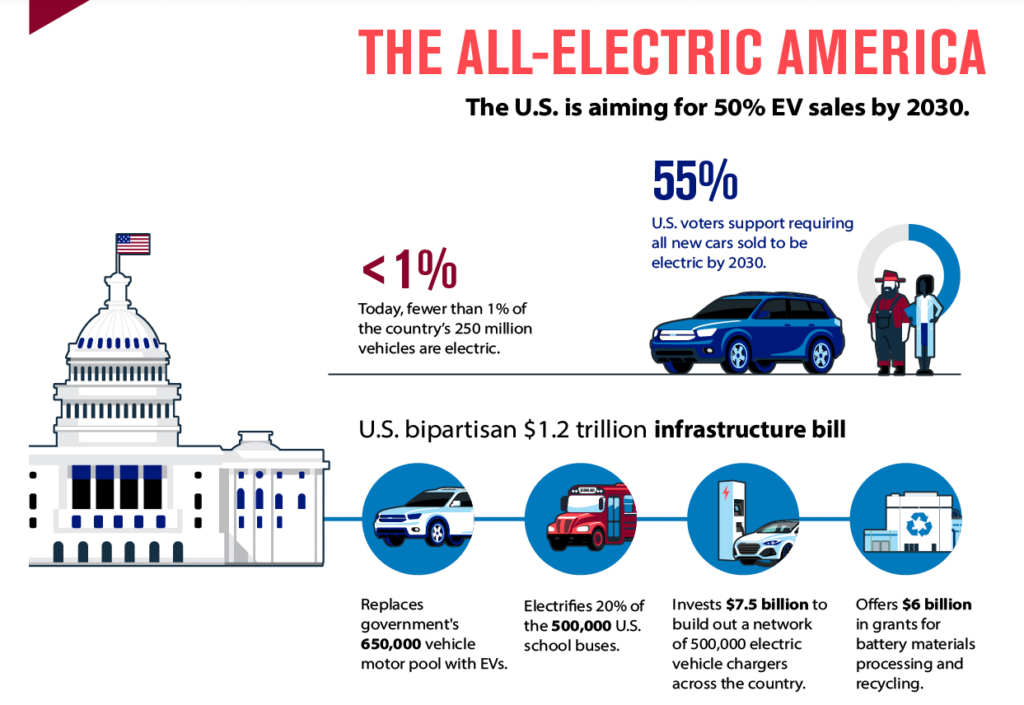

- Less than 1% of the country’s 250M vehicles today are EV.

- The US is aiming for roughly 50% of EV sales by 2030, but this has been a moving target depending on which administration is in power.

- 55% of voters support all new cars sold to be EV by 2030, which is just around the corner.

- In 2021 the US reported 40.5-gigawatt hour battery cell production from 6 mega-factories. This is projected to grow to 281-gigawatt hour battery cell production from 18 mega-factories by 2030.

- US $1.2T infrastructure bill

- Calls for replacing 650k of the government vehicle motor pool with EV.

- Calls for conversion of 20% of 500k US school buses to EV.

- Would invest $7.5B to build out a network of 500k EV charging stations across the country.

- Would offer $6B in grants for battery materials processing and recycling.

What’s the Catch?

Getting the minerals and metals needed for EV battery production will be a challenge. Rising demand has threatened shortages in necessary battery metals such as nickel, lithium, and cobalt.

Supply:

- US mineral supply is currently widely dispersed and from countries that have poor labor standards and high carbon footprints, primarily China. Domestic mining and recycling will both be necessary to meet the demand for metals.

- The US mining and materials recovery industry has a) high ESG standards, b) high level of regulatory scrutiny, c) provides high demand jobs and opportunity for local economy boosts.

- Nickel demand for EV battery manufacturing is projected to grow 29% annually 2021-2030.

- The Talon Metals’ Tamarack Nickel Project in Minnesota is the only high-grade advanced exploration stage nickel project in the US and is expected to be in the lowest quartile of embedded carbon dioxide emissions globally.

- The only operating nickel mine in the US is the Eagle Mine in Michigan, which ships its concentrates abroad for refining and is scheduled to close in 2025.

- Tesla has committed to buy 75k tons of nickel concentrate from the Talon Metals’ Tamarack Nickel Project.

- Based on the US Geological Survey, 95% of the US nickel resources are in Minnesota, Michigan, and Wisconsin.

- The Biden Administration has identified nickel processing and recycling as a priority.

- Since the development and construction of a mine can take many years, recycling is an essential source of raw materials for EV.

- Leading lithium-ion battery recycler in North America, Li-Cycle, can currently process 10k tons of material per year and has facilities construction underway to increase capacity to up to 25k tons as early as this year.

- Li-Cycle also has a refinement hub construction project underway in NY that is to produce up to 225k EV batteries annually.

- The Role of Recycling

- Battery recycling could meet up to 30% and 80% of nickel and cobalt usage in EVs respectively by 2030.

- Talon Metals and Li-Cycle are working in tandem to ensure cradle to grave traceability of nickel that will be extracted at the Tamarack Project and end up in a Li-Cycle recycling plant.

It is estimated that EV sales in the US will grow from around 500k EV in 2021 to 4M by 2030. With rising government and popular support, as well as improvements in EV technology, this is likely a long-term trend given sufficient metals supply.